Take Your Business Global, Without the High Costs

From local beginnings to a global network, Ninja Van’s journey has always been driven by one goal: enabling Southeast Asian businesses expand beyond borders.

Our cross‑border solutions make it easier to reach 46 countries at a fraction of the cost, backed by technology, regional expertise, and trusted partnerships.

100% Coverage in SEA, leading eCommerce & overseas logistics

We solve your overseas shipping challenges

End-to-end solutions

Reliable international door to door delivery or customized segmented logistics solutions.

International parcel tracking

Seamlessly track your international parcel journey with real-time visibility at every stage.

Cash on delivery

Essential for SEA’s eCommerce success, tailored to the region’s payment preferences.

Ship parcels worldwide with our international courier service

Tips and insights on international shipping

Our cross-border clients

Hear from our shippers

Past events

Other Courier Delivery Services

Freight forwarding

At Ninja Van, Freight Forwarding services include air, sea, truck and rail freight. Consult with us to find out which freight method and cargo type best suits your business.

Learn more

Fulfilment & warehousing

Picking, packing and sorting are the most tedious and time-consuming processes of any ecommerce business. With our automated technology, we can help you reduce manpower costs and other overheads while allowing you to concentrate on growing your business.

Learn more

FAQs about Our International Delivery Service

What countries do you ship to? Is there a minimum or maximum parcel size for international shipping?

Dimension and weight limits vary by destination. Click here to download the guidelines.

How long does international delivery take?

We use air freight for all international shipments to ensure the fastest possible delivery.

Delivery times may vary depending on the destination country.

Contact us to request our rate card, which includes estimated transit times.

What shipping documents are required for international delivery?

For potentially hazardous or liquid items, an MSDS (Material Safety Data Sheet) is required for us to assess shipping eligibility.

As for other export documentation, our team will assist with preparation. Common documents include the commercial invoice, packing list, and export declaration forms, depending on the destination country’s regulations.

Can I track my international parcel?

Yes, all international shipments include real-time tracking via our website or the Ninja Dashboard.

Do you offer international shipping insurance for lost or damaged parcels?

Yes, we offer standard insurance and liability to protect your parcels. Contact us to learn more about our coverage.

Do you provide export and import customs clearance support?

Yes, we handle the full end-to-end process, including customs clearance. Customs clearance is also available as a standalone solution for large enterprises.

How do I contact customer support for international shipping inquiries?

Speak to our live agent via Ninja Chat.

Learn more about Ninja Van's international delivery service

Fast, Secure, and Trusted Shipping from Singapore to Global Destinations

Ninja Van’s international delivery service provides secure and reliable shipping from Singapore to destinations across Southeast Asia and beyond. Our end-to-end logistics solutions are tailored to meet the needs of businesses of all sizes.

With real-time tracking, cash-on-delivery options, and a strong regional network, we make it easier to connect your products with overseas customers confidently.

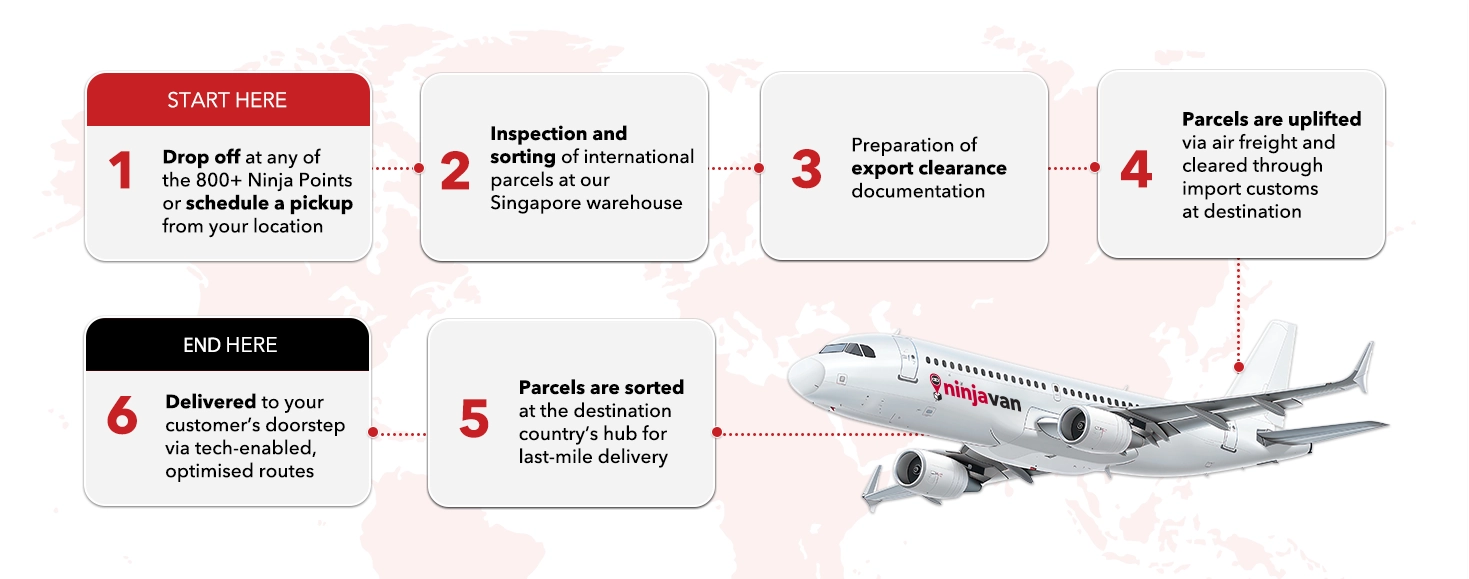

Your Parcel’s International Journey from Singapore to the World

- Start by dropping off your parcel at any of our 800+ Ninja Points or schedule a pickup from your location.

- Once received, your parcel is inspected and sorted at our Singapore warehouse.

- Our team then prepares the necessary export clearance documentation.

- The parcel is uplifted via air freight and cleared through customs upon arrival at the destination country.

- At the destination, it’s sorted at the local hub for last-mile delivery.

- Finally, it reaches your customer’s doorstep via our tech-enabled, optimised delivery routes.

Choosing the Right International Delivery Solution

At Ninja Van Singapore, we offer flexible international delivery options to match your business needs. The best solution depends on your business model and the size of your shipment:

- Business-to-Consumer (B2C) – Under 30kg

Ideal for e-commerce businesses shipping individual parcels to customers.

- Business-to-Business (B2B) – Over 30kg (Ninja Freight)

Best for wholesalers or large enterprises moving goods in bulk.

Whether you're sending a single item or full pallet loads, Ninja Van has the right logistics network to get your products where they need to be.

Send Parcel to Singapore or Other 44 Countries with Ease

We offer international courier services to 44 countries, with comprehensive coverage across Southeast Asia. Our core network includes:

- Singapore

- Malaysia

- Indonesia

- Vietnam

- Philippines

Ship Internationally from Singapore in a Few Simple Steps

Getting started with Ninja Van Singapore’s international delivery service is easy. Follow the steps below based on your needs:

For one-time or ad-hoc senders (no account required):

Send your parcel with Ninja Flexi for a fuss-free, pay-per-use experience.

For SMEs and e-Commerce businesses:

Step 1: Submit your enquiry through our contact form. A Ninja Van expert will reach out via email to understand your cross-border shipping needs.

Step 2: Receive a rate card and service agreement. Once confirmed, you'll be onboarded to the Ninja Dashboard (API integration is also available).

Step 3: Start scheduling pickups and shipping to over 44 international destinations through the dashboard.

Step 4: Track all your shipments in real-time with end-to-end visibility and proof of delivery.

With this simple, step-by-step process and dedicated support along the way, shipping internationally has never been easier.

Start Sending Your Parcel Overseas with Us!

With Ninja Van’s international delivery service, you’ll enjoy secure and affordable cross-border shipping to over 40 countries. We provide tailored logistics solutions that make international shipping simple and efficient.

As your business grows, your logistics should grow with it. Ninja Van helps you connect with customers around the world through delivery solutions you can rely on.

Ready to expand your reach? Start shipping internationally with Ninja Van! Contact us for more information or to get started.

%20SG%20international%20delivery%20website.webp)

.webp)

%20(1).webp)

.webp)

.webp)

.webp)

.webp)

.webp)